AI and Automation in Accounting: Why You Still Need an Accounting

Description

AI and automation are revolutionizing the accounting industry in 2025 by streamlining routine tasks such as data entry, reconciliations, invoice processing, and basic tax compliance. These technologies are dramatically improving efficiency, reducing human error, and freeing accountants to focus on higher-value activities like financial analysis, strategic planning, and advisory services. AI-powered tools now handle everything from real-time reporting and fraud detection to predictive analytics and scenario forecasting, allowing businesses to make smarter, data-driven decisions and adapt quickly to changing regulations and market conditions.

Despite these advances, an accounting course remains essential for several reasons. First, AI is not a replacement for human expertise but rather a powerful tool that augments accountants’ capabilities. While AI can automate repetitive processes and provide data-driven insights, it cannot replicate the professional judgment, ethical decision-making, or contextual understanding required in complex financial scenarios. Accountants are still needed to interpret AI-generated results, communicate with clients, and ensure compliance with ever-evolving tax and regulatory frameworks—areas where critical thinking and human oversight are irreplaceable.

Moreover, the integration of AI is shifting the role of accountants from number-crunching to strategic advisory, increasing the demand for professionals who can leverage both technology and financial expertise. Practical certifications—such as GST compliance, Income Tax ITR 1 to 7 practical training, and SAP FICO—are more valuable than ever, as they equip you with the skills to manage automated systems, analyze complex data, and provide actionable business advice. Employers are actively seeking accountants who can bridge the gap between digital tools and business strategy, making specialized training a direct pathway to 100% job placement and career advancement.

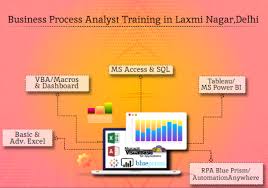

Institutes like SLA Consultants India in Delhi (110081) offer industry-focused courses that combine technical proficiency with hands-on experience in GST, SAP FICO, and income tax, ensuring you are job-ready for the AI-powered workplace. These programs not only teach you how to use automation tools but also how to interpret, validate, and act on the insights they generate—skills that are indispensable in the modern accounting landscape. GST Training in Delhi

In summary, while AI and automation are transforming accounting workflows, they are also amplifying the need for skilled professionals who can harness these technologies for deeper analysis and strategic impact. An accounting course with practical modules in GST, SAP FICO, and income tax remains your key to thriving in the evolving 2025 job market, ensuring both job security and long-term career growth.

SLA Consultants AI and Automation in Accounting: Why You Still Need an Accounting Course in 2025, 100% Job, GST Certification Course in Delhi, 110081 – Free SAP FICO Certification by SLA Consultants India, “Income Tax ITR 1 to 7 Practical Training” details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Module 1 – GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 – Income Tax/TDS – By Chartered Accountant (Direct Tax)

Module 3 – Finalization of Balance sheet/ preparation of Financial Statement- By Chartered Accountant

Module 4 – Banking and Finance Instruments – By Chartered Accountant

Module 5 – Customs / Import and Export Procedures – By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/